Investing in Non-Essential Consumer Goods

The consumer discretionary sector offers a diverse range of products and services, from luxury fashion brands and luxury cars to high-end electronics and entertainment. Industries such as retail, hospitality, travel and leisure fall into this sector, presenting growth potential within an investment portfolio. Companies in this sector produce goods and services that, while desirable, are generally non-essential if affordability becomes a constraint for the consumer.

Why invest in consumer discretionary?

During periods of economic growth, consumer spending on luxury and non-essential goods tends to increase, which can lead to higher sales and profitability for companies in the consumer discretionary sector. The consumer discretionary sector is known for its cyclical nature, often reflecting the ups and downs of the economy. It’s closely connected to consumer confidence–when economic conditions improve, this sector is likely to reap the benefits of deferred demand and heightened consumer engagement.

Consumer discretionary – quality matters

The consumer discretionary sector consists of businesses that sell goods and services considered non-essential by consumers. In economic upswings, spending on discretionary items such as designer clothing, electronics, and travel typically increases as consumers have more disposable income and higher confidence in their financial situation.

Not all companies and industries in this sector meet the requirements to be included in the MFG Asset Management’s investment universe. Extensive research is undertaken to identify the unique attributes of a company such as their economic moat and moat trend, reinvestment potential and Environmental, Social and Governance risk and opportunities that we consider enable it to generate sustainable attractive returns over the longer term. Some of these industries in MFG Asset Management’s investment universe include:

Restaurants

Restaurants within this sector range from quick service to upscale restaurants, each with its own set of opportunities and challenges. The sector benefits from the growing demand for convenience, the rise of food delivery services, and an increasing interest in diverse cuisines. However, investors must navigate obstacles like fluctuating food prices, labour shortages, food safety, and the need for continuous innovation to drive store traffic. Understanding the strategic vision and operating model of a company in this industry is key to finding quality companies. Important factors like marketing and digital strategies to attract and adapt to changing consumer experience, menu innovation in customer preference, and compliance with regulatory standards and changes are essential when considering investing in this industry.

Restaurants within this sector range from quick service to upscale restaurants, each with its own set of opportunities and challenges. The sector benefits from the growing demand for convenience, the rise of food delivery services, and an increasing interest in diverse cuisines. However, investors must navigate obstacles like fluctuating food prices, labour shortages, food safety, and the need for continuous innovation to drive store traffic. Understanding the strategic vision and operating model of a company in this industry is key to finding quality companies. Important factors like marketing and digital strategies to attract and adapt to changing consumer experience, menu innovation in customer preference, and compliance with regulatory standards and changes are essential when considering investing in this industry.

An example of a quick service restaurant in this sector is Chipotle. This popular US-based Mexican Grill restaurant chain, founded in 1993, has seen significant growth over time. With over 2,500 locations worldwide, Chipotle is now a major scaled player in this sector. Chipotle’s strength has been driven by its ability to adapt to changing consumer preferences, especially in the trend to health-conscious consumers. Chipotle has adapted, offering smaller portion sizes, fresh ingredients and healthier options. This strength in brand, product and customer needs has been critical in the growth and scaling of Chipotle.

Discretionary goods, including luxury goods

Discretionary durable goods and apparel can range from everyday brands like Nike and Adidas to luxury brands like Rolex. Critical to all companies in this segment is brand, scale and reinvestment in brand. The highest-quality segment is luxury goods.

The luxury goods market is dominated by numerous prestigious global brands renowned for their enduring legacy and commitment to excellence. Louis Vuitton, Hermès, Chanel, Rolex, Ferrari and Gucci are examples of well-known established brands in this industry. A history of luxury is a competitive advantage, conferring trust, loyalty and desirability among consumers, and often comes with the important pricing power.

These brands that have a perceived value of quality and exclusivity, often have premium price points and attractive profit margins. This industry can benefit from wealthier consumers who typically maintain spending on luxury goods even in tougher economic conditions.

“Leading companies in this sector are those that can adapt to consumer preferences.”

— MFG Asset Management Head of Franchises

Louis Vuitton Moet Hennessy is a leader in the luxury goods industry, owning over 75 prestigious brands across fashion and leather goods, perfume and cosmetics, watches and jewellery, wines and spirits. Identifying companies in this industry with a strong brand, quality management and minimal fashion risk is key to investing in this industry.

Travel

The travel industry is highly discretionary and often subject to consumer behaviour and economic conditions.

Travel companies within this sector include those operating businesses such as hotels, resorts, cruises and travel services. Often these companies are sensitive to shifts in consumer spending, especially during economic downturns. Despite its susceptibility to economic pressures, this industry can also see significant growth potential. Factors like rising disposable incomes, trends towards spend on experiences rather than material goods and the rise of the middle class, provide ample opportunities for innovative travel companies to thrive.

Booking Holdings (Booking) operates within this industry, providing online travel and related services through its many brands – Booking.com, Agoda, KAYAK, OpenTable and Rentalcars.com. The company operates in over 200 countries and provides services in approximately 40 languages. It is also highly invested in technology and loyalty to enhance the customer experience. Booking has a diverse brand portfolio and an extensive distribution network, strategically partnering with airlines, hotels, car rental companies, and other travel service providers, providing customers with comprehensive travel solutions for multiple aspects of their travel needs.

Booking focus on the consumer experience has led to its presence as the largest travel platform globally, with repeat and direct customer engagement generating sustainable growth and strong returns for investors.

Retailers

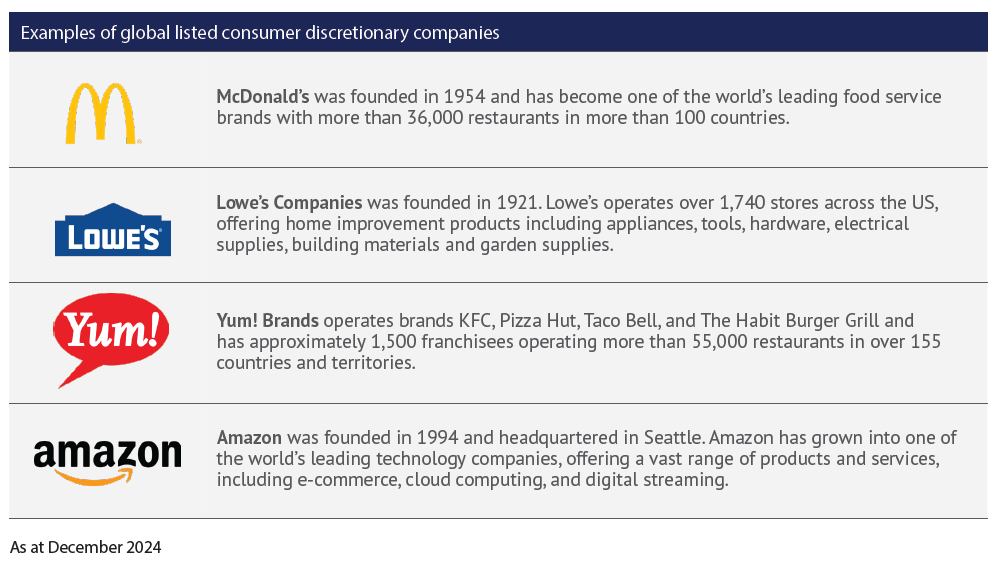

Retailers in this sector include companies that sell products such as home goods, electronics and apparel. This industry can be highly sensitive to economic cycles with increased consumer spending during periods of rising economic growth. Companies include Lowe’s, Home Depot and Amazon. Bricks-and-mortar retailers have experienced a decline in foot traffic over time due to the shift towards e-commerce. This shift has compelled traditional retail stores to significantly adapt and enhance their online presence. Consequently, they have made substantial investments in technology to develop and maintain user-friendly websites and mobile applications, as well as to utilise artificial intelligence to improve the consumer shopping experience.

With this rise in online presence, the industry has had to optimise logistics operations to meet consumer demand for faster, more efficient shipping. Leading companies in this sector are those that can adapt to consumer preferences, foster customer loyalty, innovate in a dynamic market environment, and build a strong brand presence.

What are the risks?

Investing in consumer discretionary comes with risk like any other sector, thorough research and engagement with companies can help investors to understand these risks.

Economic sensitivity: This sector is highly sensitive to economic cycles. During downturns or periods of lower consumer confidence, consumers may cut back on discretionary spending, which can affect the sector’s performance.

Consumer trends: The sector can be affected by consumer trends; for example, fashion trends. Brand strength is a key factor in offsetting the fashion cycle.

Competition: The sector can face intense competition, and companies must continuously innovate to attract consumers and maintain market share. Researching and understanding the long-term outlook for a company’s innovation path and growth are important when investing in this sector.

How do consumer discretionary companies fit into a portfolio?

Including consumer discretionary stocks in a portfolio can provide potential growth opportunities. These companies often perform well during economic recoveries and expansions. While they may experience more volatility, quality discretionary companies can often be resilient and great compounders over time.

What sets our approach apart?

There are thousands of companies listed on world exchanges. However, at MFG Asset Management we regard our eligible universe of potential investments to be only about 200 companies. These are the companies we believe to be of sufficient quality to consider for investment, and that we believe will be able to protect and grow earnings into the future. This requires rigorous fundamental research into the economics of the company and a deep understanding of the company’s strategic direction and the industry in which it operates.

At MFG Asset Management, this focus on quality companies represents the core of our investment philosophy and goes directly to achieving our investment objectives for our investors.

Important Information: This material has been produced by Magellan Asset Management Limited trading as MFG Asset Management ('MFG Asset Management') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an MFG Asset Management financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. MFG Asset Management makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. MFG Asset Management will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MFG Asset Management. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Further information regarding any benchmark referred to herein can be found at www.mfgam.com.au/funds/benchmark-information/. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of MFG Asset Management.